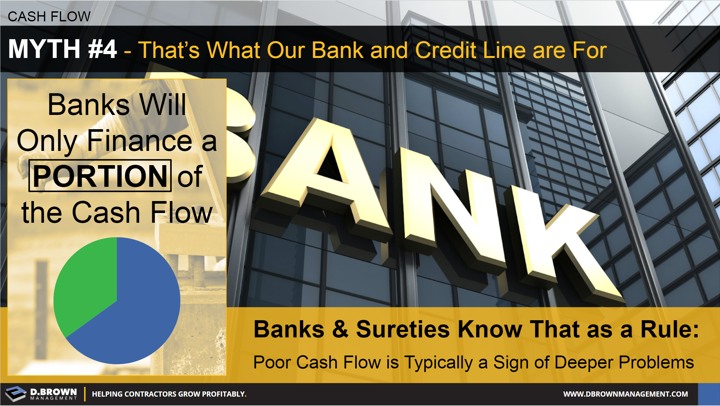

Fact 4.1: Banks will only finance a portion of your cash flow needs. They will have specific loan covenants related to how much working capital you need to have, quality of receivables and customer concentration.

Fact 4.2: Banks and sureties know that as a rule poor cash flow is typically a sign of deeper problems.

Fact 4.3: When the economy is good the loan covenants and their enforcement will loosen up. Combined with the optimism of strong backlogs this causes many contractors to take their focus away from some of the basics of great capital management practices.

Fact 4.4: When contractors are smaller; especially emerging ones the loan covenants and capital ratios that sureties work off of are significantly looser than when there are many millions of dollars at stake. If you are a contractor planning to grow make sure you put great capital management policies in place early.

Fact 4.5: When the economy tightens and contractors need the most help with cash flow banks and sureties will tighten their covenants, restrict lending and enforce much more rigorously. This cycle is what causes debt crises including the mid-1980’s and the recent one in 2010.

We are revamping our publicly available cash flow workshop that includes 18 techniques that contractors can use to accelerate cash flow. Stay informed of updates on release.