A project team has seven basic objectives and those tie into the contractor’s high-level scoreboard.

The basics:

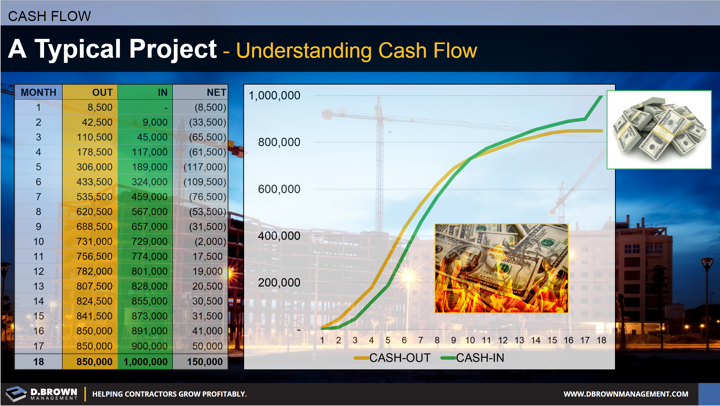

- A typical project’s profitability

- Simple explanation of cash flow

- Details of costs and billings by the month

This S-Curve chart shows just the cumulative cash flows in and out at the project level. Overhead is excluded from this calculation for simplicity. The numbers are all based of the monthly data.

As you can see it is not until month 11 that the project becomes cash flow positive and that is without covering any overhead!

Look at what happens when you factor in overhead

We are revamping our publicly available cash flow workshop that includes 18 techniques that contractors can use to accelerate cash flow. Stay informed of updates on release.