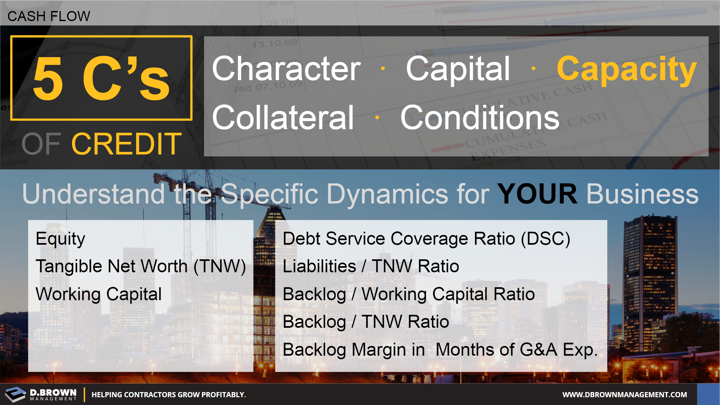

The 3rd of the 5Cs of Credit is how much capacity your business has to profitably build the projects, ensuring payback of the loan or minimal risk in the case of insurance or bonding.

Capacity is calculated in several ways with different ratios or levels set, depending on the type of contractor, length of projects, and the character of the owners and the financial partner. Some of the more common measures are:

- Debt Service Coverage Ratio, which Greg Martin describes well.

- Liabilities / Equity typically 2:1 or better. Often, Tangible Net Worth (TNW) will be looked at instead of equity.

- Backlog / Working Capital. Varies widely depending on the length of the backlog and type of contractor. Typically, 10:1 for a specialty and 20:1 for a GC are safe ranges. Note that you should adjust the basic Working Capital calculation (current assets - current liabilities) for related party transactions, past due accounts, inventory, and retentions more than 180 days out, etc.

- Backlog / TNW

- Backlog Margin / Average Monthly G&A Expenses. This essentially tells you how many months you can see your bills being paid in the future. This varies significantly per contractor, but anything less than 5 months starts to get a bit scary.

You should develop internal ratios and policies that suit your business and align with your financial partners.