Remember the basic math formula for ownership transitions.

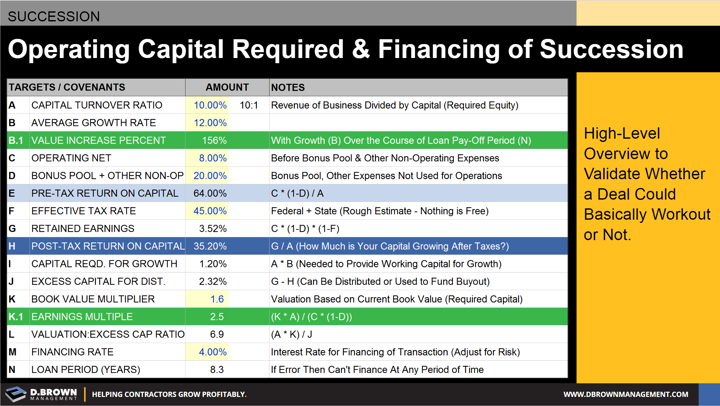

With that in mind, we often start with this simple calculator to look at the company’s ability to generate the cash required for a deal.

With some very basic numbers. Doing so allows all parties involved in a transaction to see what will generally work. We consider this the parallel to the initial conceptual sketches and discussions at the very beginning of a construction project.

You can tell all the basics from this model, including capital levels, future projected value growth, and estimated pay-off periods. When you have a few concepts that will generally work, you can build more complicated models and bring in advisors to help with the “Value Engineering” phase.

There is no sense modeling a deal structure if the basics won’t work. Remember that no deal structure will “create” capital.