Don’t let the marginal gains achieved so far with Cash Flow Tips 1-15 get squandered by poor collection practices. Using this rhythm or something similar will:

- Provide a good double check on your internal processes to identify improvements

- Build stronger relationships with your customer

- Improve the speed at which you get paid

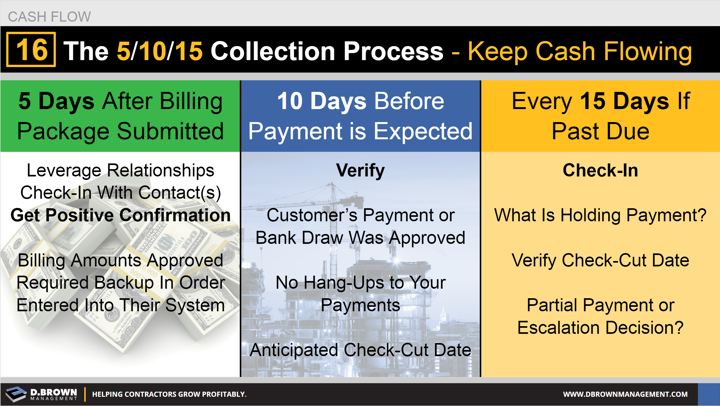

Here is the basic rhythm that should be systematically followed and managed by someone who is NOT directly involved in the billing process to provide a good check-and-balance:

- Five (5) Days after the billing is submitted, make contact with their Accounts Payable and verify that the billing amounts and all backup are OK. Ensure that it is entered to their accounting system and there is nothing holding up payment on your end. Preferably do this via phone so you can “hear” things that may not be said.

- Ten (10) Days before you expect to be paid, check in again just to confirm that everything is still good to go and that there are no issues on their end.

- At intervals of no more than 15 Days, follow-up with all past-due receivables until you get confirmed communication in return.

You have the opportunity at each stage to fix the problem, including escalations where necessary. Remember that just sending an email IS NOT communication unless they respond back and are clearly moving things forward.