The legal system is just as complex and trying to get every possible issue contingency covered can also make the deal structure extremely complex.

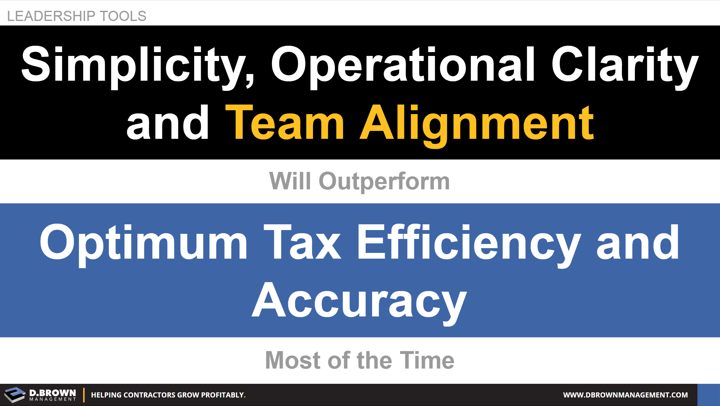

While you should always strive toward optimum tax efficiency and precise accuracy for every possible future scenario, this needs to be balanced with the negative performance impact if the team loses operational clarity and alignment.

The problem is that on the surface, things like tax savings are easy to calculate and seem very black and white - obvious choices.

However, if this extends the negotiations for months -- or even years -- it is difficult to estimate the cost to the business performance during that period.

- How simply can every member of the management team describe the deal, what is in it for them, and what they can do to improve business performance?

- Does the structure truly align everyone to either take advantage of a growing market or stick together to mitigate the impact of a shrinking market?

- Can the deal structure be used as a future model for ownership transitions, paving the way for truly sustainable growth?

There is a reason why Chapter 6 in Extreme Ownership is called “Simple.”

Focus first on a simple model of the deal that is easy to explain and aligns everyone most of the time. Then bring in advisors to look at the model for “Value Engineering” from a tax and legal coverage standpoint. Be careful not to over-engineer and take long-term value out of the deal.