The simple equation is capital needed as a percentage of revenue multiplied by your growth rate as a percentage divided by one minus your effective tax rate. This gives you the percentage of pre-tax profitability that must be set aside for growth with the rest being available to distribute to shareholders.

Example: A contractor has capital needs of 10% and plans on growing an average of 15% to meet their strategy and three-year business plan. They are structured as an S-Corp and their combined state and federal tax rate is effectively 40%. They must retain 2.5% of their Revenue each year to fund that growth. 10% x 15% = 1.5% / 60% = 2.5%.

Disclaimer: This is a very simple formula to be used as a rule-of-thumb for planning and designing your capital management policies.

It is conservative. There are financing strategies and tactics that can stretch this significantly, but it is important to start here as a baseline to know how far you are stretching. Every level of stretch may increase "Capital Efficiency" and "Return on Capital" but also decreases resiliency, often increasing stress, impacting longer-term growth, and sometimes ending catastrophically. Please contact us if you ever want to confidentially discuss your capital situation in more detail. We have worked through a wide range of situations.

CAPITAL NEEDS

Let's start with the basics: how much capital do your current business operations require as a percentage of revenue?

There are a variety of details we can add into this, including all the different categories of Capital-at-Risk that contractors have. We are going to start simple and just look at your balance sheet and total equity.

Grab your financial statements and look back at the last three years. If you are not using a Work-in-Progress (WIP) schedule yet, know that your balance sheet equity will swing wildly along with your revenue, and that won't present the most accurate picture of your business. While the IRS doesn't require a WIP schedule until contractors are over $25 million or so for several years, we recommend a basic WIP for any contractor with 15 or more employees (stage 2+). Contact us to discuss some simple options if this is your situation, as it is beyond the scope of this article.

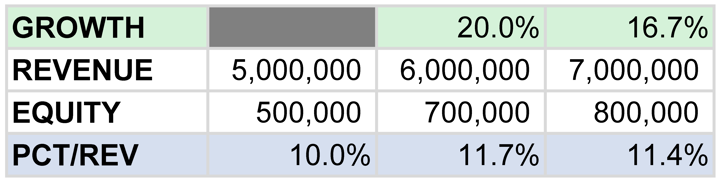

Start a spreadsheet similar to the one below.

- Since you are using your capital to build work over the following year, you will want to run similar calculations looking at the revenue for the following year. For example, the second year shown ended at 11.7% but started at 8.3% (500K/6M).

- Look at some other objective data points throughout this period, such as how much of your operating line-of-credit (LOC) you were using throughout the year, cash balance in bank, and the total size of your LOC as compared to your revenue.

- Make some notes of how cash-stressed you felt during each of these years and the reasons for it.

There are many variables that go into setting a target for how much capital you need to have locked up inside the business. Some rules-of-thumb to start with are:

- General Building Contractor (GC): 5% equity as compared to projected revenue over the next 12 months (NTM). This is the lowest percentage because GCs are leveraging subcontractors as the largest component of their job costs, and payment terms are typically pay-when-paid.

- Specialty Contractors: 10% because labor is a significant part of their job costs and paid weekly, and terms with their vendors are rarely 100% aligned with payment cycles from their customers.

- Civil Contractors: 15% for the same reasons as specialty contractors, plus the cost of their equipment fleet.

There are a wide range of factors that go into the Capital Needed standards including profitability levels, cash flow, payment terms with suppliers and subs, use of debt, and whether personal guarantees are in place.

If you look at the industry benchmarks provided by Moss Adams, you can see the averages are higher than the rules of thumb above. That is due to the wide range of variables described, including the choice (and ability) to retain enough additional capital in the business to eliminate personal guarantees.

If you are a mix, like a GC that self-performs some trades, or a specialty that has a larger equipment fleet to perform some scopes, you will be a mix of the targets above.

We've had extremely labor-intensive specialty contractors run at nearly half those targets while never touching their LOC. We've had GCs that run at double the target due to a combination of self-perform work and rapid payment of subcontractors.

What is important is understanding how much capital your business needs and ensuring you have clear policies, processes, and plans in place to ensure capital is not your constraint to growth. Please contact us to discuss your specific situation, including how variables like succession impact your need for capital and growth.

GROWTH RATE

This is relatively straightforward.

- Look at your backlog runoff, including opportunity pipeline, to estimate your growth over the next year.

- Look at your historical trend of growth.

- Look at your 3-Year Business Plan - even if it is on a notepad.

EFFECTIVE TAX RATE

Also pretty straightforward. If you are in earlier stages of growth and paying taxes on a cash basis, this may be skewed. As a safe number, refer to your state and federal tax rates assuming you are operating at the profitability level you expect to reach in the next three years. For most contractors, just using the maximum bracket is close enough. Remember, we aren't trying to build a perfect model or file tax returns, but rather to develop some conservative metrics that can be used for planning purposes, including for ownership transitions.

So, what do you do with this metric?

- Set hurdle rates for incentive compensation programs.

- Set capital management policies for shareholder distributions, dividends, and/or loans.

- Help your whole team understand the underlying components and what every level and role in the organization can do to improve this metric.

- Consider use of working capital in the opportunity selection, bid, proposal, and contract negotiation processes.

- Reverse the formula plugging in your pre-tax profitability as a percentage to calculate your maximum growth rate.

Caution: Unless your profitability is at least consistently at benchmark averages, we would not typically recommend growth as your first priority. Stabilize and refine your operations, develop your team more, then focus on growth.

Capital is one of the three basic constraints along with labor and available market.