All of the trends that are changing the construction industry today require economies of scale and capital to truly take advantage of.

The biggest winners will be those leaders who can effectively balance their vision for what’s next in the industry with relentless and disciplined execution while leveraging capital.

Private Equity firms are seeing that trend and taking a bigger interest in the construction market. They have a keen interest in scaling the Return on Capital of 20-35% that contractors operate at.

Their model has started to shift from typically asset heavy purchases to a growth mindset with the construction market starting to check both of those boxes.

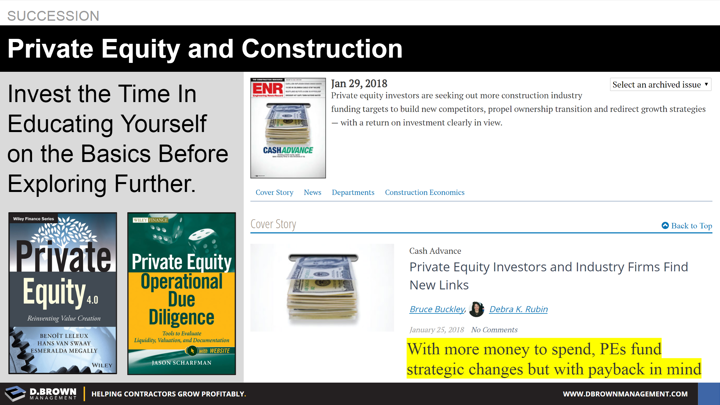

A recent ENR article pointed out to increased PE deals in the industry.

PE can be a solid exit strategy for the right type of contractor and anything done to make your company truly valuable to a PE firm will increase it’s value all around.

Invest a few days in reading about the industry, how the firms operate, and how typical deals are structured before you start exploring this further: