Bechtel consistently ranks at the top of ENR Top 400. Part of this is from their capabilities and capacity to build the largest mega-projects nearly anywhere in the world. It is easy to rationalize away the quotes from Bechtel as something only a large international contractor could do.

To build and maintain that capability, they needed to have great market strategies supported by aggressive "Get Work" capabilities.

We would encourage you to look deeper at those principles and evaluate your business against them. We have successfully tailored and applied these principles to contractors of all sizes and types. With the discipline to deliberately work in this direction, all contractors can dramatically change their business.

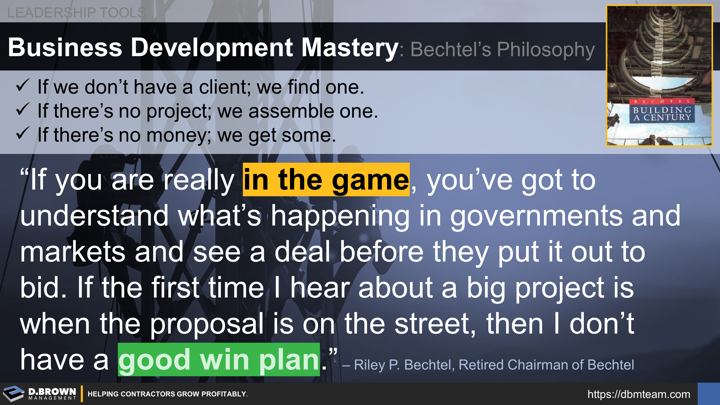

Start with the first three basic statements about Bechtel's approach:

- If we don’t have a client, we find one.

- If there’s no project, we assemble one.

- If there’s no money, we get some.

“If you are really in the game, you’ve got to understand what’s happening in governments and markets and see a deal before they put it out to bid.

If the first time I hear about a big project is when the proposal is on the street, then I don’t have a good win plan.”

– Riley P. Bechtel, Retired Chairman of Bechtel

SELF-EVALUATION: Ask yourself and your leadership team the following questions.

- Do you have a clear definition of your "Ideal Client" including what are nice-to-haves and non-negotiable deal breakers?

- Looking back 12 months, who are the top 3 new clients you have developed that have the most future potential?

- Describe your process for identifying potential clients as well as the key influencers they turn to. Please include all the people and tools involved.

- Describe your process for building relationships with the people and companies on that list starting with how you prioritize the list and initial outreach. Please include all the people and tools involved.

- Do you understand the project owner's business so well that you are involved in the process of creating the initial concept (left of this diagram) of a project then helping them through every stage of design with your preconstruction services?

- Do you have both the expertise and relationships to help the project owner get their project financed and to make it "Pencil Out" including tax incentives?

- Do the market(s) that you have chosen to compete in allow you to know about and participate early when construction programs and specific projects are first being conceptualized? Don't be super quick to answer 'NO' to this question. There are almost always players in the market who know about things way in advance and use it to their advantage.

- Looking at your opportunity pipeline and bid logs from the last 12 months, how early were you involved in each of them? You can simply rank them as early, middle, or late stage. Late stage would be after request for proposal (RFP) or bid request was sent out. Early stage would be anything to the left side of where this chart begins.

- How effectively do your opportunities align with your strategy and your operations and is it sized right to meet your business goals?

All relationships begin with a simple conversation.

Please contact us to confidentially discuss the specifics of your market(s), vision, and team. We help contractors navigate growth including:

- Analyzing and refining strategic market choices to best position for sustainable growth in all economic conditions.

- Aligning the whole team around these choices and the plans for building the capabilities required.

- Building the advanced business development capabilities which is where it all starts.

- Building the preconstruction capabilities that will be required.