This is usually calculated based on some average of the last 3-5 years earnings and weighted toward the more current years. This is looked at as an estimate of how the business can be expected to perform going forward.

Consistency in earnings and smart growth will typically increase the multiplier, while customer concentration and other volatility will decrease it.

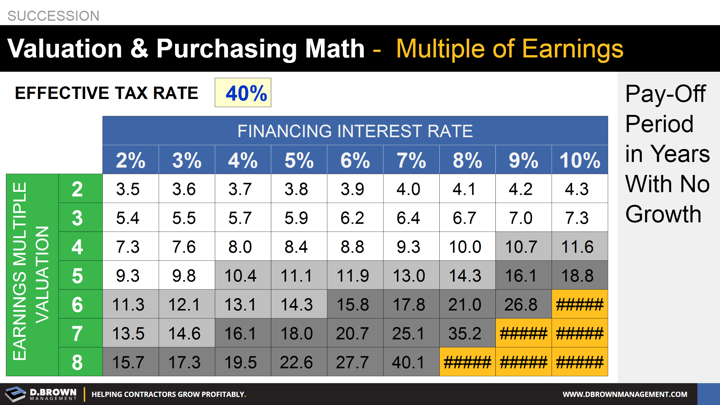

The matrix shows how long in years at various loan interest rates it would take to pay for the business out of earnings, assuming minimal growth. Remember that growth will increase the earnings but will also require additional capital.

Some may adjust the earnings for EBIDTA (Earnings Before Interest, Depreciation, Taxes, and Amortization). Be cautious when running the pay-off calculations with this method because the interest expenses will likely remain and are a cash expense. Replacement of the assets that are being depreciated or amortized will not likely be able to wait until the business is fully paid for, so you need to factor those future cash expenses into the model.

Remember that the business must provide a financial return for both the current owner and future owners, so financing periods beyond 10-15 years won’t likely create the right incentives.