Construction Management at Risk (CMAR) and Design-Bid-Build (DBB).

Construction Manager at Risk is the preferred delivery method for many of the largest 400 contractors with about a quarter of them using CMAR for 75% or more of their work. Project delivery methods are a strategic choice that is integrated with market choices.

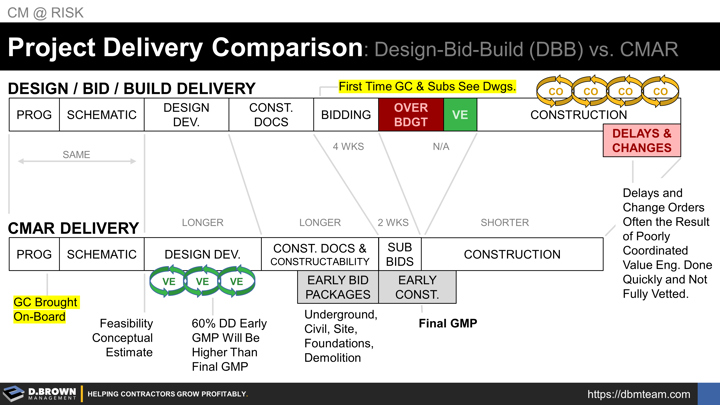

All projects must go through the same stages. The difference with CMAR is that the GC and CM roles are combined, with the contractor being selected based on qualifications and brought into the project early, often near the last part of the programming phase.

This allows a more accurate feasibility estimate to be completed at the end of the schematic phase with continuous value engineering (VE) throughout the design development phase.

While this takes longer than the DBB method, time is quickly made up because bid packages for early construction work can get created quickly and work started.

For the DBB method, the GCs and subs won’t see the bid packages until after the construction document phase is completed. With no involvement in the design, the VE process is rushed and drawing revisions are often poorly coordinated.

While competitive bidding often leads to an initial low price, studies show that DBB projects frequently have cost and schedule overruns.

Managed effectively, the CMAR is one of the best delivery methods for many different project types.

CMAR can lower risks and costs for all parties while accelerating delivery and helping mitigate the talent shortages.

Choosing CMAR as a project delivery method requires building robust business development and preconstruction capabilities. If you are in the "Early Game" then you have the relationships, reputation, and trust to be involved in the discussions that started before the chart above, when the project or construction program was just an idea.

All relationships begin with a simple conversation.

Please contact us to confidentially discuss the specifics of your market(s), vision, and team. We help contractors navigate growth including:

- Analyzing and refining strategic market choices to best position for sustainable growth in all economic conditions.

- Aligning the whole team around these choices and the plans for building the capabilities required.

- Building the advanced business development capabilities which is where it all starts.

- Building the preconstruction capabilities that will be required.